alaska sales tax on services

This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC. Multiply before-tax list price by decimal tax rate to find sales tax.

How Do State And Local Sales Taxes Work Tax Policy Center

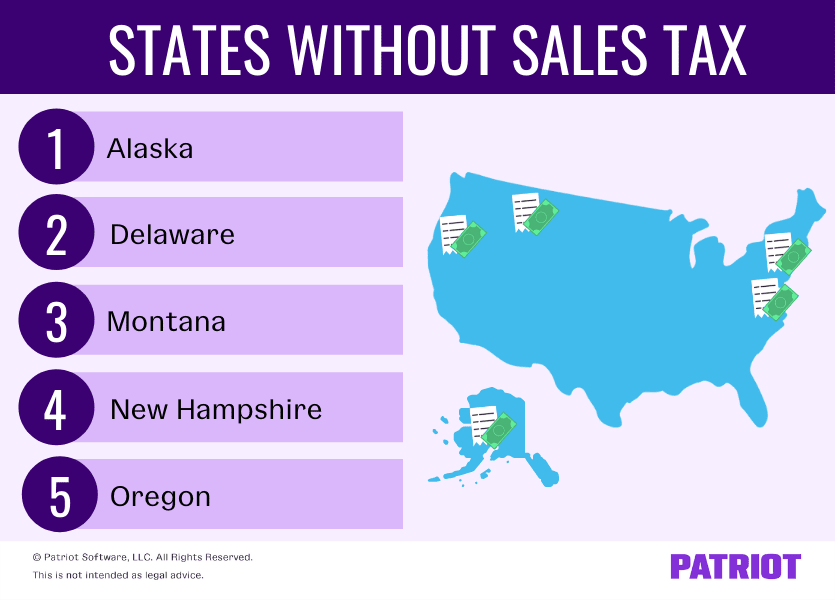

Alaska Delaware Montana New Hampshire and Oregon.

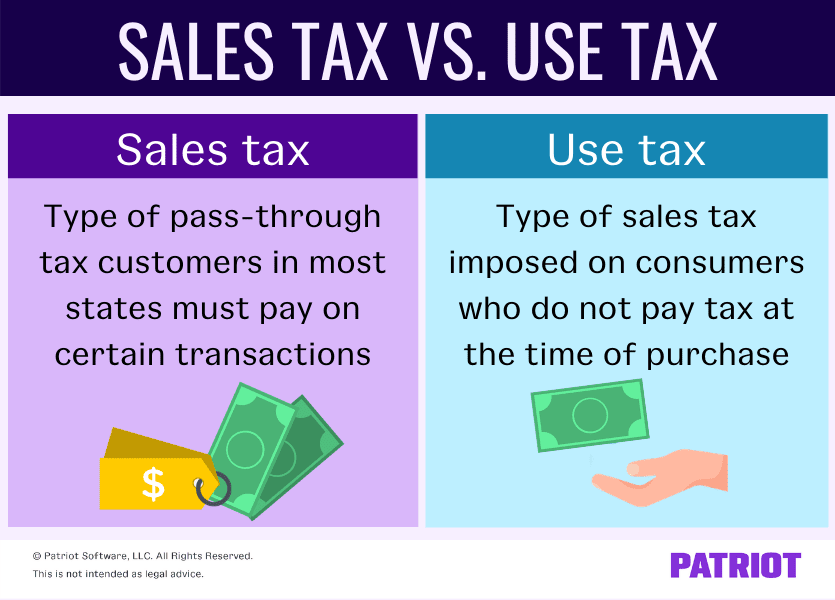

. Sales tax is remitted by the seller while use tax is remitted by the buyer. States have a statewide sales tax which is collected on most consumer purchases made within state borders. Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods.

Welcome to the Alaska Sales Tax Lookup. In-state Sales The state of Texas follows what is known as an origin-based sales tax policy. Sales tax is a tax on the sale of goods and services.

You can automate sales tax calculation on every transactionfast and securely. State Substitute Form W-9 - Requesting Taxpayer ID Info. Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels.

A sales tax is levied on retail sales of goods and services and ideally should apply to all final consumption with few exemptions. State of Alaska Department Administration Division of Finance. California has the highest state-level sales tax rate at 725 percent.

Alaska is often added to this list too. Different Sales Tax Rates Apply to Fuel. In the US and the District of Columbia all states except Alaska Delaware Montana New Hampshire and Oregon impose a state.

However the states rules are a bit complex. Must pay sales tax in the state of California. States other than Alaska Delaware Montana New Hampshire and Oregon collect statewide sales taxes.

Alaska Delaware Montana New Hampshire and Oregon. Five states currently do not have general sales taxes. STATE SALES TAX RATES AND FOOD DRUG EXEMPTIONS As of January 1 2022 5 Includes a statewide 125 tax levied by local governments in Utah.

Explore sales and use tax automation. The 2010 health care reform law imposed a 10 percent federal sales tax on indoor tanning services effective July 1 2010. The sales tax is 5 in Juneau while Anchorage and Fairbanks do.

Only five states dont impose any sales tax. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the purchase price are also subject sales tax. In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in.

Sales tax calculator to calculate tax on a purchase and find total sale price including tax. As of 2020 local. State Office Building 333.

Of these Alaska allows localities to charge local sales taxes. District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information. Must pay sales tax in the state of Arizona.

There is no sales tax in the state of Alaska. A sales tax is levied on retail sales of goods and services and ideally should apply to. And travel services for State government.

Must pay sales tax in the state of Alabama. This page discusses various sales tax exemptions in Arizona. Present the Ohio Sales Tax Exemption form to claim sales tax exemption.

While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation. All but five US. Compare 2022 sales taxes including 2022 state and local sales tax rates.

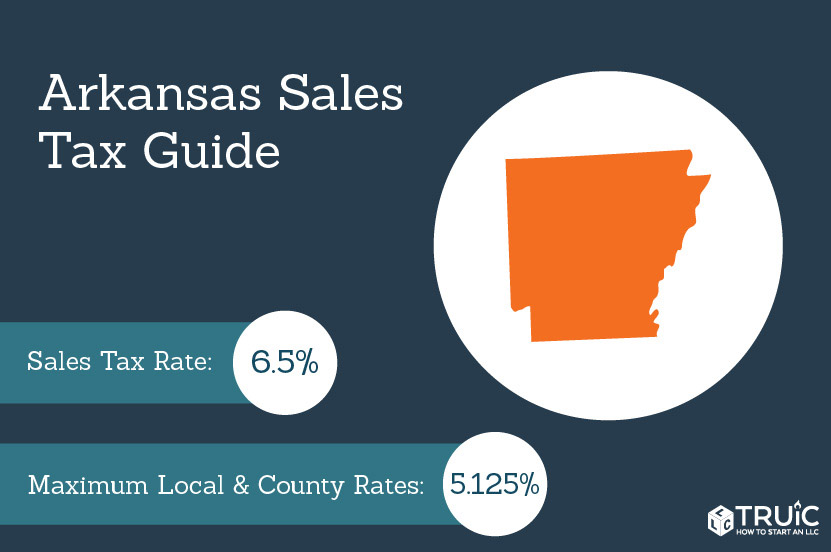

Alaska Delaware Montana New Hampshire and Oregon. Must pay sales tax in the state of Arkansas. 4 Food sales subject to local taxes.

Some examples of exceptions to the sales tax are. Vertex is the leading and most-trusted provider of comprehensive integrated tax technology solutions having helped 10000 businesses since 1978. Sales taxes are generally collected on all sales of tangible goods and sometimes services completed within the state although several states have started moving toward levying sales taxes on residents who make purchases online as well.

3 Tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund. Sales Tax Exemptions in Arizona. Eleven more states enacted sales tax laws during the 1960s with Vermont as the last in 1969.

Take advantage of automated tools and outsourcing services to collect. Local taxing authoritieslike cities and boroughsparticipate in ARSSTC to share their local sales tax rates and taxability information through this portal. In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

While there is no sales tax in Alaska local governments are endowed with the ability to impose taxes on certain goods and services. Five states do not have statewide sales taxes. This includes Texass sales tax rate of 6250 Aransas Pass Countys sales tax rate of 1000 Aransas city tax rate of 0500 and Marys local district tax rate of 0500.

Remote Seller Filing is Available for Participating Local.

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

States Without Sales Tax Article

When Did Your State Adopt Its Sales Tax Tax Foundation

Sales Tax Vs Use Tax How They Work Who Pays More

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax By State Is Saas Taxable Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Updated State And Local Option Sales Tax Tax Foundation

Arkansas Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

Sales Tax On Grocery Items Taxjar

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax District Of Columbia

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

.png)

States Sales Taxes On Software Tax Foundation

Do I Have To Charge Sales Tax Sales Tax Laws Nexus More

Where Amazon Collects Sales Tax Map Excel Grid

The Geography Of Taxation Tips Forrent Infographic Study Fun Geography